World Economy

BRICS New Development Bank: A Second Bretton Woods or a New Trend with its Own Future?

© Reuters

The main institutions of the Bretton Woods system, which have existed since the Second World War, are rapidly losing their economic weight. At this time, key actors in the developing world are coming to the fore, calling into question the out-dated rules of the game, including the hegemony of the West. Instead of destroying the legacy of the last century, they offer an alternative economic system where each player is able to influence important decisions at the international level.

The idea of building an alternative reality was the result of attempts by the West to transfer dominance in the political sphere to the economy: the Bretton Woods International Monetary Fund and the World Bank began to put forward political demands when providing loans to the countries of the Global South. The BRICS countries, who do not agree with this practice, have proposed their own concept for building the future of financial stability - the New Development Bank (NDB).

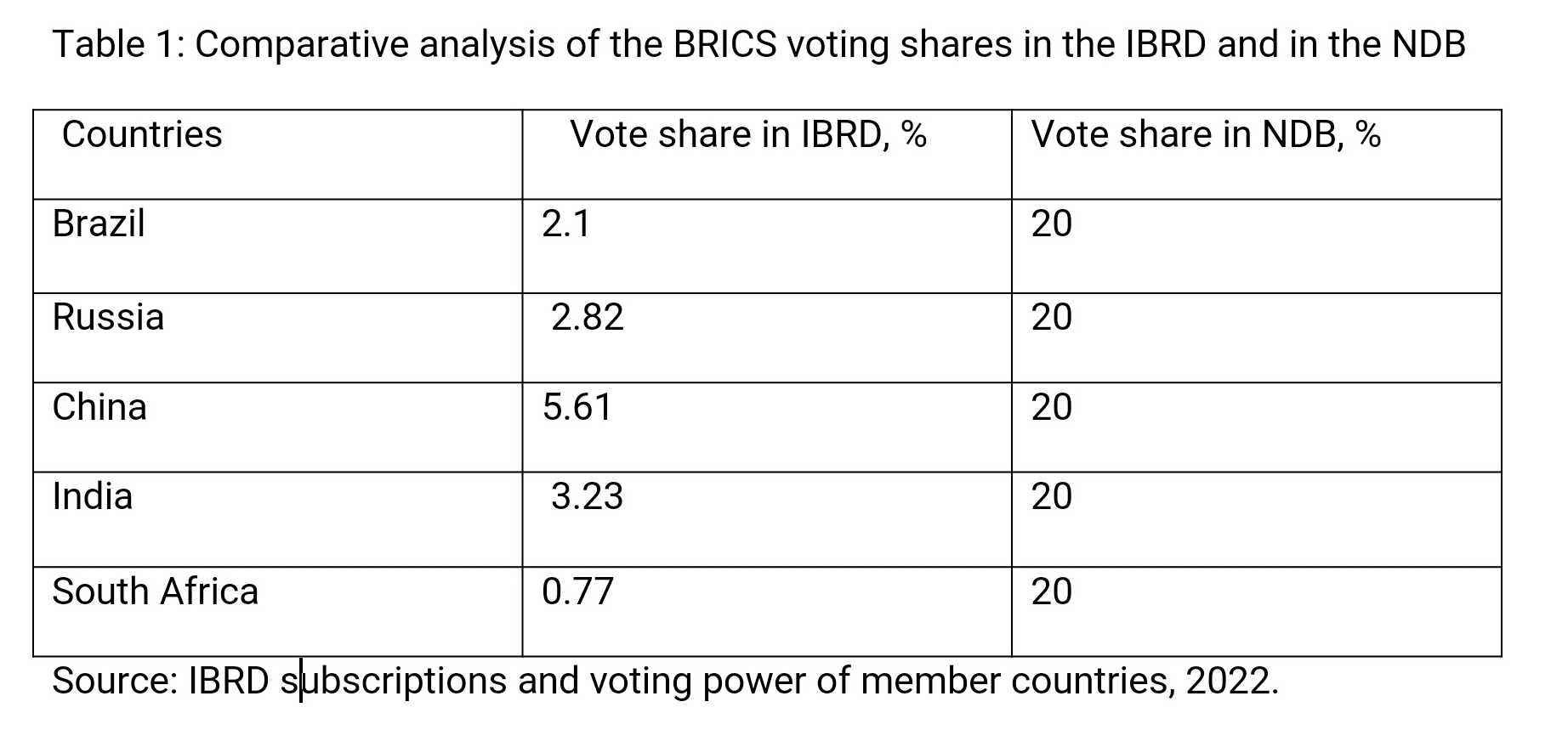

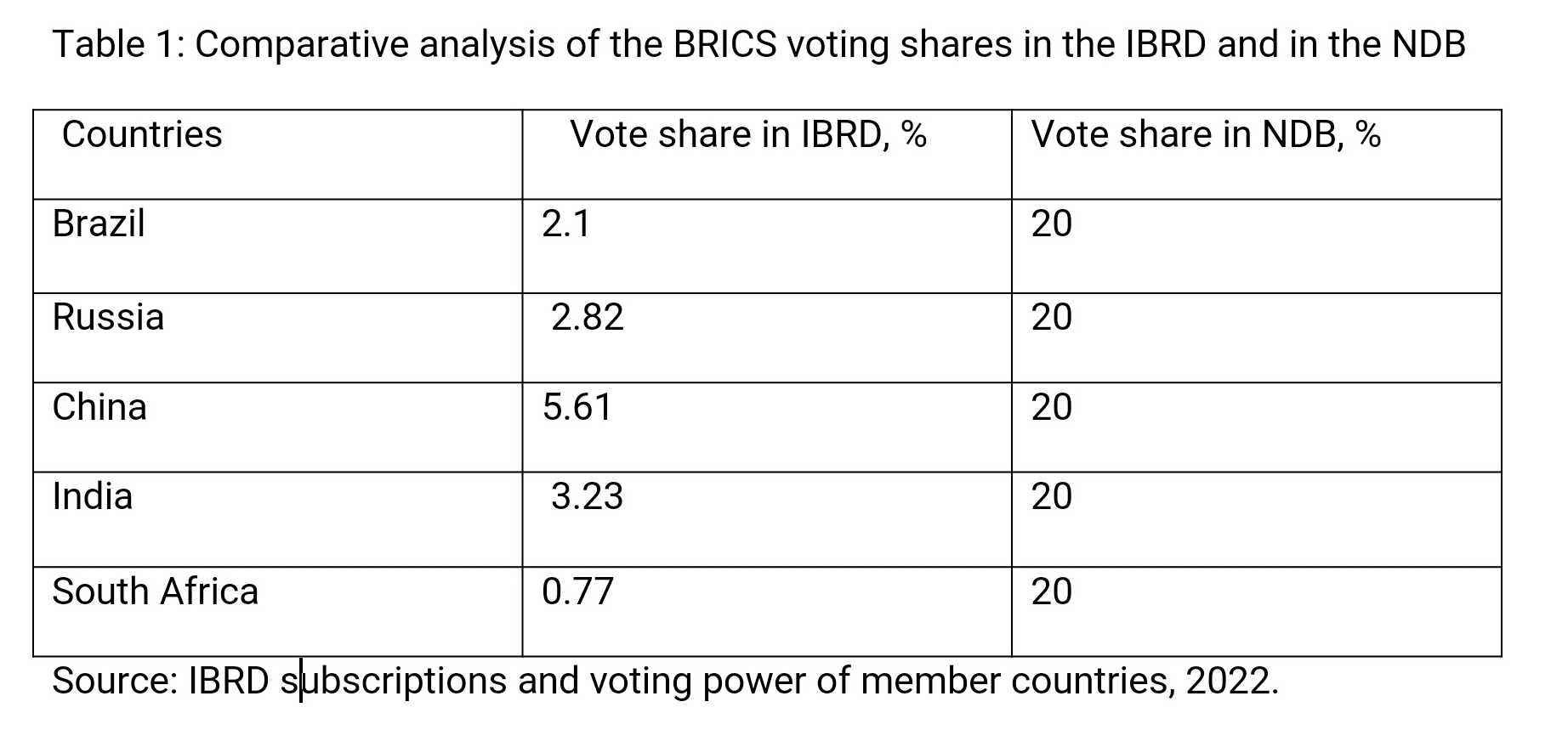

The main catalyst for the creation of the New Development Bank was the shift to the emerging market countries within existing international financial institutions (see Table 1). Insignificant voting shares among the representatives of the developing world in international economic organisations brushed aside the hopes of the BRICS member states to build a world financial architecture within Bretton Woods institutions independently of the political landscape and economic potential of the country. In fact, the lack of chances for developing countries to have a real impact on the process of making key decisions reduces their participation in international organisations to a zero-sum game: in any case, the opposite side would be in a winning position.

The New Development Bank demonstrates an alternative approach to the distribution of voting shares of developing countries: the BRICS strategy assumes partnership on the basis of equality, regardless of the country's economic potential.

Unlike the development bank created by the BRICS countries, traditional international development banks do not have the necessary capabilities to meet the rapidly growing demand for investment in infrastructure projects, primarily from developing countries, where demand is estimated by experts at $1-2.3 trillion. The vast majority of international development banks were created in an era when the developed countries of Europe dominated alongside the United States and Japan. It differed significantly from the current political realities, which are based on a progressive movement towards multi-polarity. So, the ability of international development banks to respond to the growing needs of the economies of the developing world every year raises more and more doubts.

The New Development Bank, on the contrary, has confirmed its effectiveness in the face of global challenges: the Bank's operational activities to combat the coronavirus pandemic ensured a relatively soft landing for the economies of the five countries, even in the most acute phase of the Covid crisis. Thus, the Bank allocated more than $9 billion to finance government programmes to restore the economy, which significantly mitigated the effects of the crisis and facilitated adaptation to the new post-pandemic realities. The provision of anti-crisis loans by the Bank and the calculation of the risks associated with the pandemic piqued the interest of nations that are not members of the BRICS. In particular, Bangladesh, Egypt, Uruguay and the United Arab Emirates became members of the Bank. This expansion confirms the commitment of the NDB's strategy as a leading development vehicle for emerging economies.

As the lobbying of Western interests by the Bretton Woods institutions continues amid the current distribution of votes of the member countries of these organisations, the effective activity of the New Development Bank tips the scales in favour of supporting developing countries and shows great prospects for transforming into a full-fledged platform for expanding economic and financial cooperation. In May 2022, the Board of Governors of the Bank adopted a rather ambitious Development Strategy for the 2022-2026 period; the priorities outlined by the Strategy can be reduced to five main categories of the Bank's activity.

Development of settlements in national currencies

The local currency funding initiative is primarily aimed at reducing reliance on the US dollar and other international settlement currencies. The coordination of efforts in this area will contribute to raising the international status of the national currencies of the NDB member states, preclude currency risks and greatly facilitate mutual trade between the BRICS countries.

New Development Bank Membership Expansion

In 2021, the Bank opened its doors to four new member countries and will follow a similar strategy in the future in order to expand the geography of the infrastructure projects it finances. In order to make the development of the Bank more dynamic, it is desirable to involve countries with high credit ratings and large reserves in its activities. In this regard, the eyes of the Bank's member countries are especially focused on Southeast Asia, particularly Indonesia and Thailand; the expansion of cooperation with them will make the association more representative. The entry of other regional leaders is also beneficial for the New Development Bank: in Latin America one candidate is Argentina, in the Middle East, Saudi Arabia is a candidate.

The NDB beyond economic and financial cooperation

Every year the New Development Bank is gaining geopolitical weight, displacing the traditional concept of the superiority of developed economies on the world stage. As the Bank's capacity grows, the need to expand the scope of its activities is increasingly felt: from economics, the Bank's member countries are shifting their focus to discussing a broader agenda. A striking example of the revision of priorities in the direction of responding to global challenges is the Bank's desire to finance projects in the field of food and energy security, climate change, and healthcare. The latter has firmly entered the agenda: voices supporting the creation of a BRICS Medical Association are growing louder and louder. The high level of dynamism with which the association is developing clearly demonstrates its potential to consolidate the efforts of the member countries: expanding the scope of the Bank's activities will benefit everyone.

Raising the profile of sustainable development and green projects

Against the backdrop of the increasing importance of the environmental agenda in international realities, the green initiatives of the New Development Bank are becoming clearer: funding for green projects is rapidly gaining momentum. In 2016, the NDB placed its first issue of "green bonds" on the Chinese interbank market; the amount totalled 3 billion yuan, the income from the issue was allocated to support the environmental initiatives of the member countries of the association. Thanks to such initiatives, the movement towards the implementation of the sustainable development goals has been effectively continued: the NDB provided a loan to China to finance three projects related to green energy, and most recently it announced support for the Russian BRICS Clean Rivers initiative. In the foreseeable future, a consolidation of efforts to promote the green initiatives of new members of the Bank is expected. Thus, the United Arab Emirates, which confirmed its commitment to the sustainable development agenda, and Al Husseini, the representative of the country, declared the priority of ecology in the framework of multilateral cooperation. At the next meetings, the NDB may approve the allocation of funds for Uruguay’s green hydrogen project, which confirms the NDB’s priority within the environmental agenda for many years to come.

Building partnerships with the private sector

In order to implement the aforementioned initiatives, the New Development Bank is likely to resort to more active engagement with the private sector in the future. Attempts to coordinate the activity of the business structures of the association were made back in 2019, during the year of the presidency of Brazil, whose President proclaimed the deepening of business partnership for global development. Three years later, in 2022, such initiatives have received approval from the participating countries: at the 7th annual meeting of the Board of Governors of the New Development Bank, Brazil’s delegation noted the potential for the convergence of the business structures of BRICS members to finance infrastructure projects. Already, the NDB has all the necessary conditions for intensifying such cooperation, so an increase in the role of the private sector may take place in the near future.

The idea of building an alternative reality was the result of attempts by the West to transfer dominance in the political sphere to the economy: the Bretton Woods International Monetary Fund and the World Bank began to put forward political demands when providing loans to the countries of the Global South. The BRICS countries, who do not agree with this practice, have proposed their own concept for building the future of financial stability - the New Development Bank (NDB).

The main catalyst for the creation of the New Development Bank was the shift to the emerging market countries within existing international financial institutions (see Table 1). Insignificant voting shares among the representatives of the developing world in international economic organisations brushed aside the hopes of the BRICS member states to build a world financial architecture within Bretton Woods institutions independently of the political landscape and economic potential of the country. In fact, the lack of chances for developing countries to have a real impact on the process of making key decisions reduces their participation in international organisations to a zero-sum game: in any case, the opposite side would be in a winning position.

The New Development Bank demonstrates an alternative approach to the distribution of voting shares of developing countries: the BRICS strategy assumes partnership on the basis of equality, regardless of the country's economic potential.

Unlike the development bank created by the BRICS countries, traditional international development banks do not have the necessary capabilities to meet the rapidly growing demand for investment in infrastructure projects, primarily from developing countries, where demand is estimated by experts at $1-2.3 trillion. The vast majority of international development banks were created in an era when the developed countries of Europe dominated alongside the United States and Japan. It differed significantly from the current political realities, which are based on a progressive movement towards multi-polarity. So, the ability of international development banks to respond to the growing needs of the economies of the developing world every year raises more and more doubts.

The New Development Bank, on the contrary, has confirmed its effectiveness in the face of global challenges: the Bank's operational activities to combat the coronavirus pandemic ensured a relatively soft landing for the economies of the five countries, even in the most acute phase of the Covid crisis. Thus, the Bank allocated more than $9 billion to finance government programmes to restore the economy, which significantly mitigated the effects of the crisis and facilitated adaptation to the new post-pandemic realities. The provision of anti-crisis loans by the Bank and the calculation of the risks associated with the pandemic piqued the interest of nations that are not members of the BRICS. In particular, Bangladesh, Egypt, Uruguay and the United Arab Emirates became members of the Bank. This expansion confirms the commitment of the NDB's strategy as a leading development vehicle for emerging economies.

As the lobbying of Western interests by the Bretton Woods institutions continues amid the current distribution of votes of the member countries of these organisations, the effective activity of the New Development Bank tips the scales in favour of supporting developing countries and shows great prospects for transforming into a full-fledged platform for expanding economic and financial cooperation. In May 2022, the Board of Governors of the Bank adopted a rather ambitious Development Strategy for the 2022-2026 period; the priorities outlined by the Strategy can be reduced to five main categories of the Bank's activity.

Development of settlements in national currencies

The local currency funding initiative is primarily aimed at reducing reliance on the US dollar and other international settlement currencies. The coordination of efforts in this area will contribute to raising the international status of the national currencies of the NDB member states, preclude currency risks and greatly facilitate mutual trade between the BRICS countries.

New Development Bank Membership Expansion

In 2021, the Bank opened its doors to four new member countries and will follow a similar strategy in the future in order to expand the geography of the infrastructure projects it finances. In order to make the development of the Bank more dynamic, it is desirable to involve countries with high credit ratings and large reserves in its activities. In this regard, the eyes of the Bank's member countries are especially focused on Southeast Asia, particularly Indonesia and Thailand; the expansion of cooperation with them will make the association more representative. The entry of other regional leaders is also beneficial for the New Development Bank: in Latin America one candidate is Argentina, in the Middle East, Saudi Arabia is a candidate.

The NDB beyond economic and financial cooperation

Every year the New Development Bank is gaining geopolitical weight, displacing the traditional concept of the superiority of developed economies on the world stage. As the Bank's capacity grows, the need to expand the scope of its activities is increasingly felt: from economics, the Bank's member countries are shifting their focus to discussing a broader agenda. A striking example of the revision of priorities in the direction of responding to global challenges is the Bank's desire to finance projects in the field of food and energy security, climate change, and healthcare. The latter has firmly entered the agenda: voices supporting the creation of a BRICS Medical Association are growing louder and louder. The high level of dynamism with which the association is developing clearly demonstrates its potential to consolidate the efforts of the member countries: expanding the scope of the Bank's activities will benefit everyone.

Raising the profile of sustainable development and green projects

Against the backdrop of the increasing importance of the environmental agenda in international realities, the green initiatives of the New Development Bank are becoming clearer: funding for green projects is rapidly gaining momentum. In 2016, the NDB placed its first issue of "green bonds" on the Chinese interbank market; the amount totalled 3 billion yuan, the income from the issue was allocated to support the environmental initiatives of the member countries of the association. Thanks to such initiatives, the movement towards the implementation of the sustainable development goals has been effectively continued: the NDB provided a loan to China to finance three projects related to green energy, and most recently it announced support for the Russian BRICS Clean Rivers initiative. In the foreseeable future, a consolidation of efforts to promote the green initiatives of new members of the Bank is expected. Thus, the United Arab Emirates, which confirmed its commitment to the sustainable development agenda, and Al Husseini, the representative of the country, declared the priority of ecology in the framework of multilateral cooperation. At the next meetings, the NDB may approve the allocation of funds for Uruguay’s green hydrogen project, which confirms the NDB’s priority within the environmental agenda for many years to come.

Building partnerships with the private sector

In order to implement the aforementioned initiatives, the New Development Bank is likely to resort to more active engagement with the private sector in the future. Attempts to coordinate the activity of the business structures of the association were made back in 2019, during the year of the presidency of Brazil, whose President proclaimed the deepening of business partnership for global development. Three years later, in 2022, such initiatives have received approval from the participating countries: at the 7th annual meeting of the Board of Governors of the New Development Bank, Brazil’s delegation noted the potential for the convergence of the business structures of BRICS members to finance infrastructure projects. Already, the NDB has all the necessary conditions for intensifying such cooperation, so an increase in the role of the private sector may take place in the near future.

The New Development Bank is only at the beginning of its journey to create meaningful alternatives to the Bretton Woods institutions. According to analysts, by 2026 the New Development Bank will expand its total package of approved loans to $60 billion: such ambitious forecasts among experts indicate that the Bank is on the right track. The purpose of this path is the global mission of the NDB - to increase the confidence of the developed world in developing countries in the global economy and a clear demonstration that emerging markets are becoming a real force to be reckoned with.

In 1944, the Bretton Woods System was de facto created by two states (the United States and Britain), which at that time had the authority and resources to impose their will on four dozen states that were guided by them during the world war. Today there is no state or group of countries on the planet capable of imposing its will on the entire world community. A new or radically reformed Bretton Woods, of course, should take into account the opinion of all the states of the planet, regardless of their size. The solution of such a problem through negotiations will last for many years, while the likelihood of success will be minimal, writes Valdai Club expert Stanislav Tkachenko.

Opinions

Views expressed are of individual Members and Contributors, rather than the Club's, unless explicitly stated otherwise.