The African market is not a panacea and one hundred percent recipe for the development of an effective industrial policy of Russia. This is just one of many directions in which the development of foreign economic activity of our country should proceed. However, to neglect its importance would be extremely short-sighted, writes Alexander Zotin, Director of the International Center for Applied African Studies, Russian State University for the Humanities (RSUH).

The experience of East Asian countries shows that successful economic development is hardly possible without a well-thought-out, export-oriented industrial policy. However, Russia is experiencing difficulties working in the traditional export markets of developed countries, primarily the European ones. The main constraints are the natural decline in market volumes due to the demographic situation in developed regions, a stringent regulatory environment, as well as intense competition from technologically advanced Western companies. The African market does not have these restrictions and can be viewed as a promising external platform for the export competencies of Russian high-tech companies.

The history of economic development since the Second World War suggests that effective industrial and export policies are among the key elements which drive rapid growth. And vice versa: classical institutional and liberal recipes for economic development, such as improving the business climate, developing institutions, achieving macro-stabilisation (through effective fiscal and monetary policies), increasing investment in human capital, reducing government intervention in the economy, opening domestic markets for foreign goods and capital — all of this may not be enough to achieve high growth rates.

To understand the recipe for success, it is worth looking at those who have managed to achieve it. During the post-war period (1960-2014), only 16 out of 182 countries were able to cross the threshold of 50% of the US GDP per capita. Excluding resource economies, the states that reached this level in the 1970s and the countries that joined the EU, only four countries remain — Hong Kong, Singapore, South Korea and Taiwan (and in fact, only two, if you exclude city states). Perhaps China will soon be added to them, but so far this is only an assumption.

Many economists have tried to decipher the success of the East Asian countries by explaining their growth either by sustained capital accumulation (like Paul Krugman) or statistics (like William Easterly). For some, this has become convincing proof that the “Asian miracle” is the result of “perspiration, but not inspiration”, to use Krugman’s phrase. And this led back to purely institutional recipes for growth, without the need for any industrial or export policy.

However, simple capital accumulation is hardly sufficient to explain growth. The share of investment in GDP from 1970 to 1990 in South Korea averaged a very solid 30%. But countries that did not achieve similar success, for example, Iran, Jordan, Portugal and Saudi Arabia, had almost the same level. At the same time, labour productivity growth in these countries turned out to be very low.

In a relatively recent IMF study, economists Fuad Khasanov and Reda Cherif, on the basis of a formal model, note that economic growth is nothing more than the result of a combination of industrial/export policies and a large set of very different, often random external and internal factors that can hinder the development of a particular economy (natural disasters, wars, ethnic and class conflicts, negative conjuncture of commodity markets, etc.). Industrial and export policies, therefore, can enhance or, on the contrary, neutralise the consequences of simple luck or bad luck.

Since there are many random negative external and internal factors, and they are often independent of each other, it is quite possible that the economy collapses despite the correct policy. This is important and not entirely trivial. We should understand that in such a situation it is rather difficult to distinguish between the effects of bad economic policies and occasional negative factors; each of them can devalue good policies.

Moreover, underdeveloped countries are often far more susceptible to occasional negative factors than their richer neighbours. The poorer the economy, the more fragile it is. Problems with a single industry, or even one power plant, or one port in a poor country can lead to losses that are unthinkable in a developed economy. Simply because in a developed economy, the loss of one intermediate product or service often can be quickly compensated by its analogue. A developed economy is “anti-fragile”, to use the terminology of the American financier and philosopher Nassim Taleb.

American economist Charles Jones develops this thesis: “In rich countries, there are enough substitution possibilities that these things do not often go wrong. In poor countries, on the other hand, any one of several problems can doom a project. Obtaining the instruction manual (the ‘knowledge’) for how to produce socks is not especially useful if the import of knitting equipment is restricted, if replacement parts are not readily available, if the electricity supply is erratic, if cotton and polyester threads cannot be obtained, if legal and regulatory requirements cannot be met, if property rights are not secure, or if the market to which these socks will be sold is unknown.”

There are enough examples of this kind for the countries of Africa, Latin America and Asia. It is difficult to pursue a successful industrial policy when, for example, once every few years a hurricane strikes your country (as in the Caribbean), which can cause damage wiping out several percent of your GDP, that is, neutralising all potential economic growth. In Africa there are more than enough examples of poor governance. But often the same effect takes place — even correct policies which would bear fruit in a developed country have often been offset by various kinds of negative factors and ultimately led to suboptimal results. The astute British Africanist Richard Dowden, in his book Africa: Altered States, Ordinary Miracles elaborates, among other things, on the example of Zimbabwe under the leadership of President Robert Mugabe. A more detailed analysis of the situation reveals that the figure of the same Mugabe is very different from the usual image of an extravagant dictator created by the Western media. Mugabe was quite an intelligent and subtle politician; perhaps he would outmatch many of his modern Western colleagues. But he found himself in a difficult situation, being sandwiched in a political sense between a handful of white elites and the radical wing of his black compatriots. The ethnic conflict was added to this. As a result, all attempts to bring the country onto the trajectory of sustainable development have failed.

Similar problems are typical for most African countries, it is enough to just point out, that only two countries in sub-Saharan Africa are ethnically homogeneous, the rest are forced to live within the borders outlined by the former metropolises, for which the internal conflict in the colonies was (and in many ways still remains) one of the elements of governance.

To summarise, all politicians can be wrong, but the relative cost of error for the economy of Mozambique can be much higher than, for example, for the United States. The thesis “all happy economies are similar to each other, and each unhappy economy is unhappy in its own way” in this context becomes important purely empirically; namely, that the negative experience of poor countries often does not provide useful information. Their personal unhappiness can be the result of any of a wide range of negative exogenous factors, as well as bad or good politics. Simply, we should not look too closely at Zimbabwe, Venezuela and Argentina for what went wrong. On the contrary, only those few happy economies provide useful information, in which a set of random exogenous factors turned out to be favourable and at the same time, industrial policy increased their effect.

After analysing the experience of economies that grew rapidly during the post-war period (basically, these are the same South Korea and Taiwan), Cherif and Khasanov focus on the following aspects of successful industrial policy:

-

Intervention of the state in the “advanced” spheres of industry. Policies need to be pursued to support technologically complex tradable sectors in order to catch up with the “technological frontier”.

-

Export, export, and export again. The focus on export allows for the creation of a feedback mechanism as a proxy for an objective assessment of the effectiveness of industrial policy. Plus, it is a mechanism for quick adaptation to changing conditions. It also provides an additional sales market, and for small countries, also the main one.

-

The fiercest competition (internal and external) and the strictest assessment of efficiency. Support should not be provided without evaluating performance based on short-term profit. Certain industries can receive government support, but only if they have competitors in the domestic and foreign markets.

Interestingly, these recipes do not necessarily coincide with liberal postulates about the need for tight fiscal and monetary policies. For example, as noted by the American economist of Korean origin Ha-Joon Chang, South Korea during its period of rapid economic growth in the 1960s and 70s was quite tolerant of fairly high inflation rates; that is, its economic policy, by today’s mainstream standards, was unbalanced and suboptimal. But the long-term absence of macro-stabilisation (understood as a stringent fiscal and monetary policy) did not in the least hamper the main goal — the achievement of high rates of economic growth. The same can now be said for China, which has been showing decades of strong growth despite (or rather, thanks to) high budget deficits.

Returning to the recipes for growth, we note that the protection of direct government intervention in market mechanisms, including direct protectionism, is also not very typical of the modern economic mainstream. In many ways, it is a product of the role of the state in rethinking economic processes. The essence of the latter can be reduced to the fact that the market is not necessarily always effective in selecting the most promising industries. Both venture capitalists and government officials often read the same books and research reports and are under the influence of a shared intellectual environment.

Accordingly, the choice of promising industries is difficult, but, apparently, approximately equally difficult for both private entrepreneurs and state officials. Most states have similar priorities for a possible technological breakthrough — artificial intelligence, semiconductors, nuclear energy, nanotechnology, biotechnology, quantum computers, etc. The Italian economist Mariana Mazzucato in her book Value of Everything: Making and Taking in the Global Economy provides many examples of successful government intervention in several areas later taken up by the private sector.

The choice of promising industries is difficult. It may take decades before the prospects of this or that main industrial development path becomes clear. For example, the EU countries have invested hundreds of billions of euros in renewable energy technologies for two decades. But is there any firm conviction that they are on the right track? The energy crisis of 2021 in Europe saw a fantastic increase in gas, coal and electricity prices and, accordingly, a greater degree of de-industrialisation and “energy poverty” among the population, makes this an issue to be seriously questioned. On the other hand, a vector of technological development, incorrectly chosen by one country or group of countries, can create prospects for the development of an alternative vector in another country or countries. Someone’s mistake can be the basis for someone else’s victory.

The situation is made even more difficult by the implementation of breakthroughs in promising industries. It is unlikely that the successful experience of the Korean chaebols, which have built the shipbuilding, steel, automotive, electronics and chemical industries from scratch (but with the support of the state), can be successfully repeated in today’s conditions. On the one hand, you can really try to distil successful approaches to industrial policy, as the IDF researchers did. On the other hand, they are likely to end up being highly specific and contextual beyond the general principles of high-tech investment, export orientation and accountability. There are no guarantees of success, especially since the technological complexity of advanced industries is now much higher than it was 50 years ago, and the gap may be such that it will take much more effort to bridge it than before. It is possible that at some stage, bridging the gap with the technological frontier will be impossible in principle with any industrial policy, even the best possible. We can only hope that this is not the case.

The second principle of successful industrial policy, export orientation, at first glance does not raise any objections. For decades now, export orientation and diversification have been almost the main imperatives of economic development. Economists offer very sophisticated approaches, including looking for possible “traps” in the product space that can block development potential at a suboptimal level . In essence, if you do not even know what and where to export; economists will help you with this.

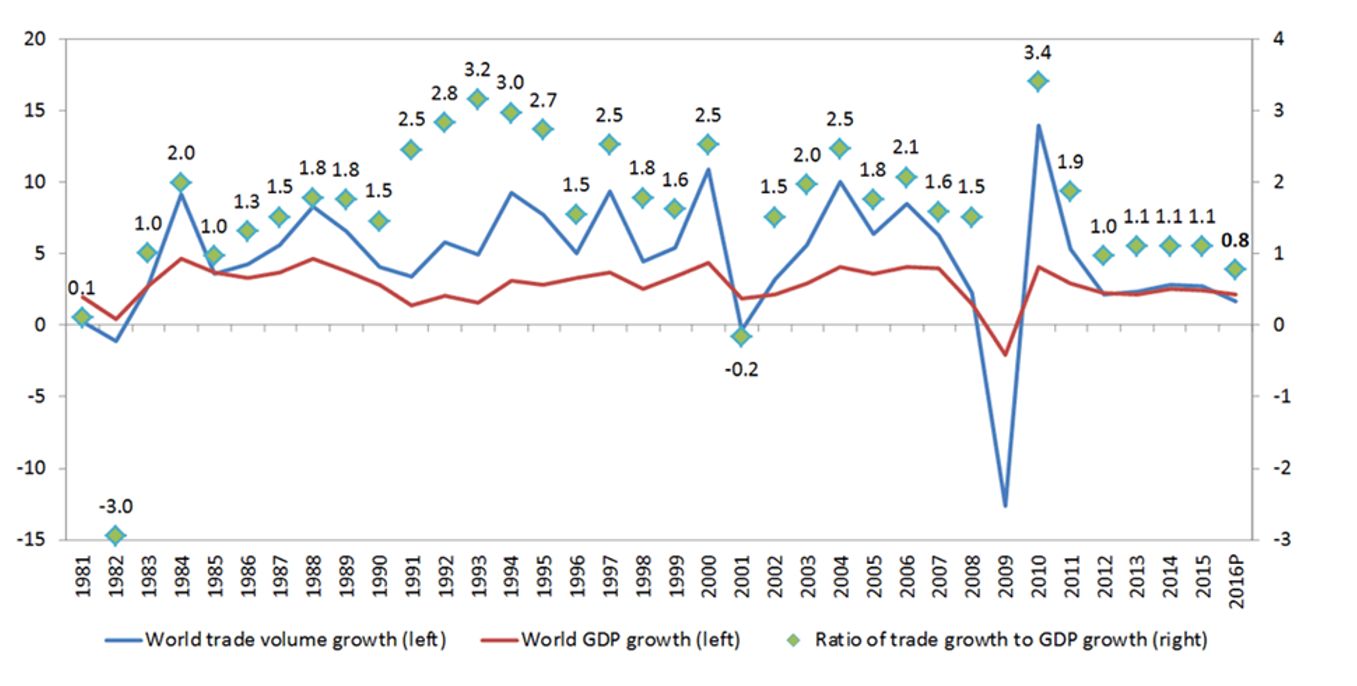

But do not forget that the context itself, which unambiguously dictates the export orientation, has changed a lot as of late. The driver for the development of “retardate” economies throughout, almost, the entire second half of the twentieth century was the growth of world trade, many times faster than the growth of world GDP. Since export markets grew much faster than domestic ones, the obvious recipe for development was the export orientation of the economy. It was not only an effective feedback loop for assessing the development of “national champions”, but also a promising, fast growing market.

Moreover, the main “heroes” of the Asian miracle — South Korea and Taiwan — received preferential access to Western markets amid US fears about the possible absorption of these countries by their communist brother-neighbours — China and North Korea. Incidentally, the development of the Federal Republic of Germany is also very similar in this aspect. As a result, their industrial policy was dictated by a complex set of internal and external factors, including a huge external and internal motivation to grow in the face of a real existential threat from the outside. All this happened against the backdrop of a very specific macro-picture of the rapid growth of world trade.

Source: WTO Secretariat for trade, concensus estimates for GDP

The picture today is fundamentally different. Let’s take, for example, the situation in world trade. An export-oriented industrial policy was more than relevant until the start of the global financial crisis in 2008-9. However, in the 2010s, the growth rates of world GDP and world trade were virtually equal, and the model of catching-up development through access to export markets became much more problematic.

In the 2020s, the situation has become even more difficult. In 2020, the pandemic was added to the unfolding “trade war” between the United States and China. Global trade has suffered more than global growth: it contracted 8.2% in 2020, worse than the decline in world GDP (- 3.1%). At the same time, Covid-19 seems to be becoming a catalyst for a long-standing process — economic de-globalisation, caused by trade wars and reshoring, and the return of TNCs to home markets due to the growth of production automation, which reduces the need for corporations to use countries with cheap labour. Economic nationalism and self-isolation grew even before the pandemic, and by now it has become an obvious trend. Incidentally, this is not the first time in economic history. The Belle époque of the late 19th and early 20th centuries was also a period of globalisation of world markets that ended with the First World War.

But in this possible new global context, the implementation of export-oriented growth models for emerging economies will become increasingly difficult. At the same time, the search for internal growth factors will become more important. Perhaps this will lead to the premature de-industrialisation of many developing economies and an actual deadlock in their development. How may this be avoided? What exactly can Russia do to develop industrial policy and exports?

Let’s focus on one aspect — choosing a direction for Russia’s export policy. To do this, it is important to understand which markets will be the most promising on the horizon for the next two or three decades.

Predicting the future is a thankless task. We do not know who will be the leader in economic growth in the coming decades. However, the forecast works very well in some areas. First of all, it concerns demography. According to the latest UN World Population Prospects 2019, the crude birth rate was 1.8 in the United States; it was 1.7 in China, which was also the average for all developed countries. It was 1.6 in Germany, 1.4 in Japan, and 1.3 in Italy and Spain. Let’s recall, that for the simple reproduction of the population, a total fertility rate of 2.1 is required. In addition, the population of developed countries is not young; the median age is 41 years. These numbers indicate depopulation in developed, and even in some developing countries. Depopulation is already having a serious impact on GDP growth rates, for example, in Japan, where the economy has been in de facto stagnation for more than a decade. In terms of export orientation, the developed markets of rich countries are shrinking markets, the importance of which will diminish over time.

Africa remains practically the only hotbed of positive demographic dynamics in the world. For the continent as a whole, the crude birth rate is a solid 4.44, and for sub-Saharan Africa it is even higher, at 4.72. The population of Africa is the youngest on the planet — the median age is only 19.7 years, and sub-Saharan Africa has an average population of 18.7. With such demographic prospects, the continent’s population will practically double over the next three decades — from 1.3 billion now to almost 2.5 billion by 2050 (meanwhile, the population of developed countries will remain virtually the same). For example, Nigeria will reach 400 million. In fact, that country alone will have more than half of the population of Europe in 2050.

At the same time, the future middle class will have tastes and loyalty to brands that will enter this market now, or have already entered it. It is very sad that now there is not a single Russian brand among the top 100 brands which are popular in Africa. It is clear that basically, as throughout the world, European, American, and now Chinese brands dominate. But there are also newcomers from developing countries with clever export policies, such as Indonesia and Turkey.

Africa’s advantages as a platform for Russian foreign economic expansion are not limited to demographic factors. The developed markets of the OECD countries, especially the European Union, are highly regulated, which creates the highest barriers for exporting companies from Russia. Although tariff barriers are limited by WTO rules, the same European markets have a lot of non-tariff barriers (technical standards and EU norms, phytosanitary rules, etc.). The costs for the compliance of Russian goods and services with the same European standards in certain areas are prohibitively high, which naturally discourages non-resource high-tech exports. There is so much bureaucracy in European trade policy that it was one of the reasons for Britain’s exit from the EU — in London, they were outraged by the desire of Brussels to regulate everything and everyone, including the curvature of cucumbers. The regulatory environment in Africa is generally much more favourable, although of course it differs from country to country. By the way, the same cannot be said about some other regions of emerging markets. The regulatory environment in Brazil and some Latin American countries, and in Asia (for example, in India), is extremely difficult and uncomfortable for exporters and foreign capital; it happened historically.

The third advantage of Africa is that the local market is experiencing a shortage of both high-tech companies and companies with a medium level of technology development (so-called medium hi-tech goods — LCD and LED panels, locomotives, tankers, solar panels, air conditioners, excavators, telecommunications equipment, simple electronics, water transport, diesel generators, turbines, etc.). Because of this, the African market in the past two decades has actually become a platform for the Chinese companies, “national champions”, such as, for example, telecommunications giants Huawei, ZTE or the engineering company Sany. Having gained experience in the African market, these companies, in the absence of significant Western competition on the continent, eventually got stronger and entered more developed and complex markets. What prevents Russian companies from moving in the same direction? Moreover, for them this is almost the only way — in the OECD countries, firstly, no one is waiting for them, and secondly, they will have to compete with the most high-tech companies, which have access to super-cheap credit funds because of the policy of the central banks of the USA and the EU.

Of course, the African market is not a panacea and one hundred percent recipe for the development of an effective industrial policy of Russia. This is just one of many directions in which the development of foreign economic activity of our country should proceed. However, to neglect its importance would be extremely short-sighted, just as it is short-sighted to neglect the future, expecting that it will be the same as the present. The future will be different, and Africa’s role in it will only grow.