As policy makers around the world are gearing up in crisis mode and taking important decisions to save their national economies, one thing is certain. The world economy after the confinement will be altered dramatically, more than even before, more than the aftermath of the Great Depression and the Great Global Recession, writes Marc Uzan, Executive Director of the Reinventing Bretton Woods Committee. The Macroeconomic environment will be left with the largest public deficit in history in most of the OECD countries and emerging markets, and world debt overhang in history.

“There is only one equilibrium, it is economic inactivity until the danger passes.” This is how Jason Furman, former chairman of the Council of Economic Advisers and Professor at Harvard University, summarized the exceptional state of the global economy.

No one has predicted when the virus outbreak started in China that the global economy will be heading to a near standstill, characterized by a multiple series of shocks emerging at the same time, with the same magnitude that has no precedent in world history. We can name here some of them: A manufacturing and trade shock with disruption of supply chains triggering “thy neighbor’s” dynamics choking off global supply chains. Commodity prices have also collapsed to levels not seen since the early 1970s (oil went down to 25 dollars), triggering a massive sudden stop of private capital flows for emerging markets, higher than one that they have experienced during the super tantrum episode in 2013. There is a major rise in risk aversion: 80 billion dollars has flowed out of emerging market stocks and bonds since the beginning of the outbreak according to the Institute of International Finance, nearly four times the level during the financial crisis in 2008. This situation has put numerous emerging and developing countries on the brink of a balance of payments crisis. Very soon, more than 20 countries might be asking help and support from the Bretton Woods institutions. Potential candidates are Lebanon, Ecuador or Zambia who had trouble before fulfilling their foreign debt payments. The coronavirus crisis will not only lead to a great depression only in China, Europe, Japan and the United States. It will also lead to a serious meltdown, due to the decline in global trade, the capital outflows from these countries and the fall in commodity prices.

Policy Response

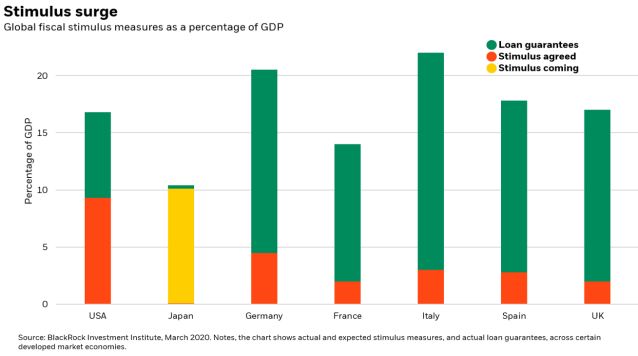

Mitigating first the health crisis has been a priority for all governments. Fiscal policy have been targeted towards social insurance. The policy response to deal with the sudden strop of inactivity in the United states has been to send a one off basic income for every household, and the other aspect of the stimulus package was directed to support small business companies. The Europeans government’ policy was to put in place numerous schemes to protect workers and companies. During this period of confinement, monetary and fiscal policy actions were taken to bridge businesses and households through the shock.

Meanwhile, European countries gave up their own fiscal rules, the 3% GDP Maastricht criteria for the time being, an historical decision. The European Commission granted EU members full flexibility in their fiscal rules to allow them to boost expenditure but provided aggressive fiscal and monetary policy actions. What is still pending is a European Hamilton moment, a European Bond issuance (the famous European Corona bond), but it seems that the north and south divide still persists. What might emerge as the compromise among the Eurozone countries might be a European Rescue Fund akin to a European Marshall Plan that will be the main tool for post-pandemic recovery for countries affected by this major shock.

As policy makers around the world are gearing up in crisis mode and taking important decisions to save their national economies, one thing is certain. The world economy after the confinement will be altered dramatically, more than even before, more than the aftermath of the Great Depression and the Great Global Recession. The Macroeconomic environment will be left with the largest public deficit in history in most of the OECD countries and emerging markets, and world debt overhang in history. We shall witness the end of the separation between fiscal and monetary policy. A dramatic shift of savings and investment around the world will occur where sovereign wealth funds will need to repatriate funds from abroad. Can the global economy become one again? Will it be the end of the paradigm of globalization? Will it stop the rise of China as a super economic power? Will the post-WWII global financial architecture collapse? Will the US dollar remain the reserve currency or will we be seeing an acceleration of digital based currencies?

-

A systemic risk of interdependence. The COVID-19 could reshape the world’s manufacturing supply. How to strike a balance between openness and protection, interdependence and self-reliance? There is also likely to be some permanent effect on China-centric global supply chains, as companies and countries reassess their reliance on China-sourced components and products, particularly ones deemed to be critical from a broadly defined national security perspective. A fundamental question moving forward will be the future of global production, French Finance Minister Bruno Le Maire alluded to this issue “Do we want to still depend at the level of 90 percent or 95 percent on the Chinese supply chain for the automobile industry, for the drug industry, for the aeronautical industry, or do we draw the consequences of that situation to build new factories, new productions, and to be more independent and sovereign?...That’s not protectionism — that’s just the necessity of being sovereign and independent from an industrial point of view.”

-

The macro policy response has been national in character. Every government has encouraged this form of economic hibernation by decree. This pandemic will leave countries, companies and also household with a higher level of debts . Major write off of debt at the sovereign , corporate and household levels will occur.

-

The virus is shaping up as an enormous stress test for globalization. It is forcing a major reevaluation of the interconnected global economy. For these reasons, it seems that we cannot compare “this recession by decree” neither with the global financial crisis of 2008 nor with the great depression of 1930. In 2008, the problem was the disruptions to the flow of finance, where central bank liquidity was able to repair. Today it is a sudden stop of production and a sudden stop of economic activity. The only outcome might be that the world might need to use the concept of bankruptcy court, the world is at standstill, and will need to concentrate on the automatic stay, the time of confinement, as a major priority to save human lives. This automatic stay will allow to draw post-virus outbreak plans akin to the postwar reconstruction of the global economy. Revitalizing trade, removing borders, building new institutions, building a global safety net akin to a global basic income.

What do we see so far in terms of global policy response that might lead us to start thinking about post pandemic reconstruction? The Federal Reserve has allowed foreign central banks to use their government bonds as collateral for short-term dollar borrowing its new repo facility. Central banks will be able to deal with a sudden stop of dollars. The Federal Reserve has become a global lender of last resort, a global central bank. After all, central banks and central banking will be reinvented: we can call it helicopter money or coordination of fiscal and monetary policy with fiscal policy becoming dominant.

The virus might be also an opportunity to move away from power rivalry, fragmentation, US-China iron curtain, global sanctions, to find and build, as John Ikenberry, Professor of international relations at Princeton, wrote: “a new pragmatic and protective internationalism.” One way toward that goal might be implementation of a coordinated fiscal stimulus, an idea the Valdai Club brought to the agenda of T20, a G20 engagement group for think tanks, earlier this year. New and creative approaches are required as we are going through the most important event of the 21st century, which has already altered the course of world history.